So, you’re at that point…

The other side to running a business… The back-office number crunching and financial reporting.

If accounting were personified, it would probably be the nerdy buzz-kill who never gets invited to the impromptu lunch time piss-up organized by the sales persona.

BUT… but, never underestimate the power of accounting – a proper reporting system WILL literally make or break your business.

Accounting won’t make you any money (unless you’re an accounting firm, I suppose), but it will certainly save you money and a lot of ball ache – which is just as important.

Fuck going through the whole accounting profession – I’m definitely not your guy for that.

But what I will go through is probably the most tangible concept in all of financial reporting – cash flow management and budgeting. What will actually be useful in terms of:

Informing strategy (and helping track a given strategy’s progress)

Forecast a project’s financial potential and requirements

Help you build-out your short, medium, and long-term plans (if you’re seeking external funding for your business, the funding party will immediately shit-can your business plan if there’s no financial projections or budget **one that makes sense)

…There’s no getting around this – if YOU, as a business owner, don’t track your financial data at least weekly, you won’t be a business owner for very long.

Cash is King

Before we progress, it’s vital that you understand the difference between cash and profit.

Nearly everyone focuses on profit (or profitability) “are we profitable?”… “How much profit did we/you make last quarter?”… etc.

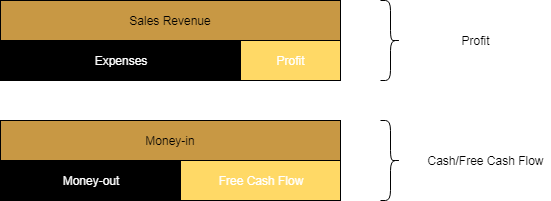

Profit – is nothing more than an abstract, measurement: it is the difference between sales and expenses. That’s it.

… “But Jordan, the whole point of going into business is to generate a profit, are you telling me losses are OK?”

Look… Long-term, you will want to be profitable (show consistent profit): because that IS our measure of success, and efficiency (efficiency just refers to getting as much benefit from our inputs/expenses as possible).

But short-term, you’ll want to focus more on cash:

“Do we have enough cash?”

“How much cash do we have?”

Your cash flow will directly affect your strategic decisions (what we can/cannot do, and it will inform you as to what needs to change)

Look at cash, not profit… You only look at your profit/profitability when you:

Are trying to sell your business/ask for funding.

Want to reduce your tax bill (corporation tax is based on profit not sales)

Your business isn’t automatically fucked because you are operating at a loss… BUT just because a business is profitable (making a profit) doesn’t mean it has sufficient cash – which is pretty damn important.

Now we’ve got that covered, we can move forward.

Setting Financial KPIs

If you’ve read my guide on testing marketing material, you’ll be familiar with the concept of KPIs.

It’s exactly the same principle for finance/cash flow management.

We will set financial KPIs in order to:

1. Determine the expense levels we mustn’t go beyond

2. Identify our expected return from a given level of financial input

If (^^ above two points) this is not the case, we can pin-point where we’ve fucked up… Like if Dave over-ordered on pencils again (ffs Dave…)

The basic point is you will forecast your spending (what is required to get $y) and keep to those limits ($x).

If you ARE over, identify why:

1. Was this a tactical change to increase our y? (if so, this is a calculated change, and thus acceptable).

2. Have costs risen (why is this, and what can we do to solve this – cheaper supplier, maybe)?

3. Did we fuck up (and where)?

This is the power of setting KPIs, we can see where and how things have changed, and review the results of our spending.

That’s it… All we are doing is providing some scale of measurability to our processes – not just accepting the numbers the market gives us.

Download the Cash Flow Budget Template provided, so the next few sections makes sense (otherwise all this shit will be pretty pointless, like me saying I’ve made you dinner, but not provided the plate lol – this is at the bottom of the post)

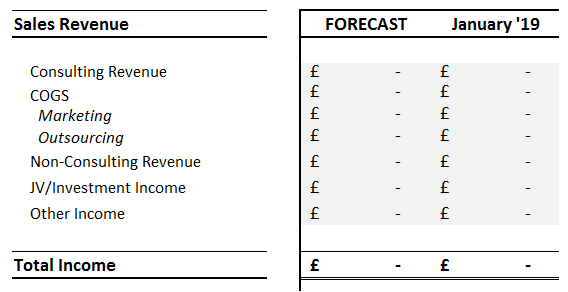

The format is in the British tax (HMRC) computation style – though the expenses are pretty much the same (wages, advertisement, etc)… Feel free to change the entries, if appropriate.

It ain’t a pretty sheet, but it gets the job done.

Fixed Costs First

Let’s focus on three key elements:

Fixed Costs

Variable Costs

Revenue

When building out your budget, these are the variables you need to focus on – if you can break these down, you’ve done 99% of the work.

Forecast your fixed costs first…

Your fixed costs are sunk… They don’t change from client-to-client. For example, whether you have 1 or 2 clients (or none) you’re rent isn’t going to change.

Your fixed costs will be the highest of all your costs (at least initially) – and they will generally be what you are paying for right now: internet, phone, rent, and so on.

“Consulting” as an expense, is a weird one.

If you outsource your operations, then you may find that this expense is variable (rises with every additional client) – as you find yourself hiring more and more contractors with each new client, or paying more to the same team members for working on additional projects.

We’ll get back to that in a moment.

In the template provided, you’ll notice two columns per month – Forecasted and Actual.

At this point ALL your budgeted costs (and revenues – which we’ll get to) must be in the Forecasted column.

What the actual number is, will be put in column attributed to that month.

Our Forecasted figure will be the benchmark – the KPI, what we must not go beyond (except revenue, if that’s over KPI that’s technically a good thing, especially if your expenses don’t go up).

IMPORTANT: Make sure you input all outgoing cash as a negative, otherwise you’re going to completely fuck up the sheet (you’ll be the first business in history to have operating profits higher than sales revenue).

I usually change the font color of all expenses (outgoings) to red to make things easier.

Variable Costs and Revenues

Next you’ll need to break-down your variable costs.

As introduced above, these are all the costs that go up every time you add a new client to your business.

For example, if we spend more on Facebook Ads in February, than we do in January, theoretically we should get more clients in February. Therefore, I chalk-up digital marketing as a VC.

(the marketing expenses associated with the fixed costs section of the template will be other marketing expenses, such as: location hiring, costs of props, and shit like that)

If you wish to include outsourcing/consulting fees as part of your VCs, you might want to split your COGS section into two, like this:

Your VCs will be put in the COGS section below your top line.

NOW you can consider your revenues.

Your revenues MUST be in ratio with your COGS… Otherwise this whole process is pointless.

For example, if you know your CPA is $500 on a $1,000 AOV service… And you wish/forecast to make $5,000 in March – your COGS will be $2,500.

(if that last paragraph was a just a bunch of letters and numbers, you’ll want to check out the KPIs post I made).

We’re being serious here, no fairy figures.

EVERY entry needs to have a reason for being in your forecast. A useful exercise – is to imagine that your budget will be grilled and destroyed by a panel of sharks/investors…

… Can you honestly justify Admin and Office Expenses at £4,411.65 in January, if a group of pinstriped clad psychopaths had your toes in a vice or your nipples skewered on meat hooks?

Hold that thought, it becomes vital later.

Cash Flow Expenses

“Wait what… I thought this whole thing was about cash flow expenses?”

… Ah, I see what’s just happened, you thought this would be straight forward? Sorry pal, if it were 100% straight forward the good people at Pricewater-MG-Teloitte-whoever-the-fuck would be out of a job.

But what we have covered so far is related to our operations (our expenses, revenues, and the like), that which is associated with the sale/production/distribution/management of our service offering.

How would we account for the money you invested in the business (‘cause that ain’t revenue)?

How would we report/forecast the purchase of expensive equipment (which holds its value over a period of time, thus not an overhead per se)?

How would we account for the money we hope to get from the aforementioned pinstripe psychos? (if you’re asking for funding – they’ll want to know where that goes)?

All that, and some other stuff you can deduce from the template, goes on the cash flow section of the budget.

Free Cash Flow

All this’ll give us the true cash pumping around our business (our free cash flow)

This is what we give a shit about remember, because this will help us decide how we can grow, and how we carry out our strategy moving forward.

Ideally, this section should be written-up after the revenue, FC, and VC sections, especially if you are deciding what amount of money you need to invest/borrow/ask/steal…

(no, no don’t do that last one *massive legal release here*).

Any amount you seek will need to be justified, so you need to determine your KPIs and use that as your foundation for such seeking.

(VC funding side note. If you can calculate your financial KPIs, and operate on a small scale for say three months – and prove you are operating to these KPIs. Any angel or VC you contact will cream themselves… Or at least they won’t cut the meeting at 15 minutes, and laugh behind your back about how much of a fucking dunce you are).

Key Assumptions

You’ll notice on the template the “Key Assumptions” tab.

This is where you’ll store your justifications – why each entry is as you have forecasted it to be.

It’s also a good habit to have physical proof of these numbers, make reference to any:

1. Invoices

2. Estimates

3. Prices

4. Pricing Structures

5. Receipts

6. Contracts

And any other form of proof you think will help solidify your justifications… Save yourself from the nipple hooks!

Habits

After all that, you now know how to produce an accurate, logical, cash flow forecast and effectively manage the cash in your business (or prove to another party how you will manage their cash).

But I know what’s going to happen now.

You’ll make your forecast, you might update the actual results twice… Then you’ll stop.

And the last 1.7K words would have been for jack-fucking shit.

So, you’ll need to get into the habit of updating your cash flow budget EVERYDAY.

No BS, no fucking around, this shit is important:

Update the actual column (the column labelled as the month which you are in) at 23:30 everyday – without fail.

(if you spend 10 minutes on this every day, it won’t take you an hour + at the end of the week)

Fill-in the Forecast column for every month on the 20th of every month before the forecasted month.

I also use the 20th of every month to review the KPIs of the previous/current month:

Are we at KPI/budget – how can we make this consistent or grow?

Are we below KPI/budget – awesome! If our revenue is as forecasted or better (now how do we make this consistent?)

Are we over KPI/budget – why? (even if revenue increased, this is still a deviation of the plan, thus inconsistent, thus prone to long-term failure; trust me, it’s a slippery slope –CONSISTENCY OVER UNPLANNED INCREASES!)

Your cash flow budget is a tool – use it.

The difference between a business with long-term potential and one prone to failure is whether it can manage its cash properly – and you can’t manage something if you don’t measure it.

Download the template and start managing your business properly.

Jordan Carter